At Costi Cohen, we are focused on securing quality commercial assets that offer long-term resilience and income security – well beyond the short-term appeal of a higher yielding property.

In the current market, fast food and service station assets continue to attract strong investor interest due to their stability, quality lease structures and national tenant profile.

Here’s why investors are backing these assets for the future –

- Strong tenant covenants offer strong income security backed by reliable, long-term occupants including major fuel providers and national QSR brands

- Long term lease agreements with multiple option periods provide genuine, long-term passive income potential.

- Annual rent reviews ensure predictable and consistent income growth over time.

- Net lease structures reduce exposure to outgoings and enhances investor net returns.

- Tenant funded maintenance and fit-outs reduce exposure to unforeseen capital expenses for landlords.

- Strategic arterial locations with commercial zoning provide exposure to high daily traffic volumes and offers strong future development potential.

- Depreciation benefits from newly built or refurbished assets can enhance after-tax returns.

“We’re seeing investors shift from chasing yield to chasing resilience. These assets are underpinned by some of the most secure tenants in the country.”

– Tas Costi, Director.

“It all comes down to the fundamentals — land, lease, and location. When the tenant is built for the long term, so is the investment.”

– Sasha Rodriguez, Senior Associate.

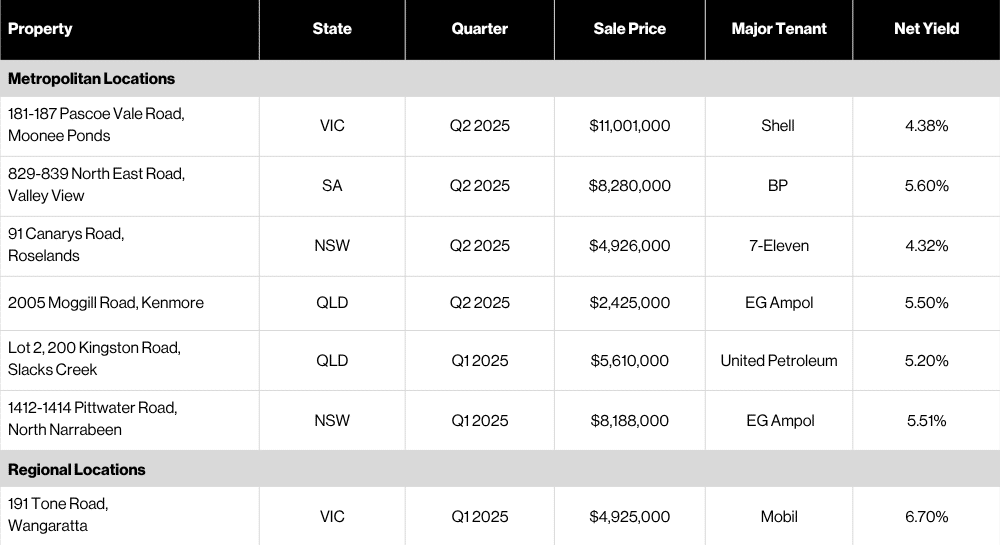

Service Station Transaction Highlights

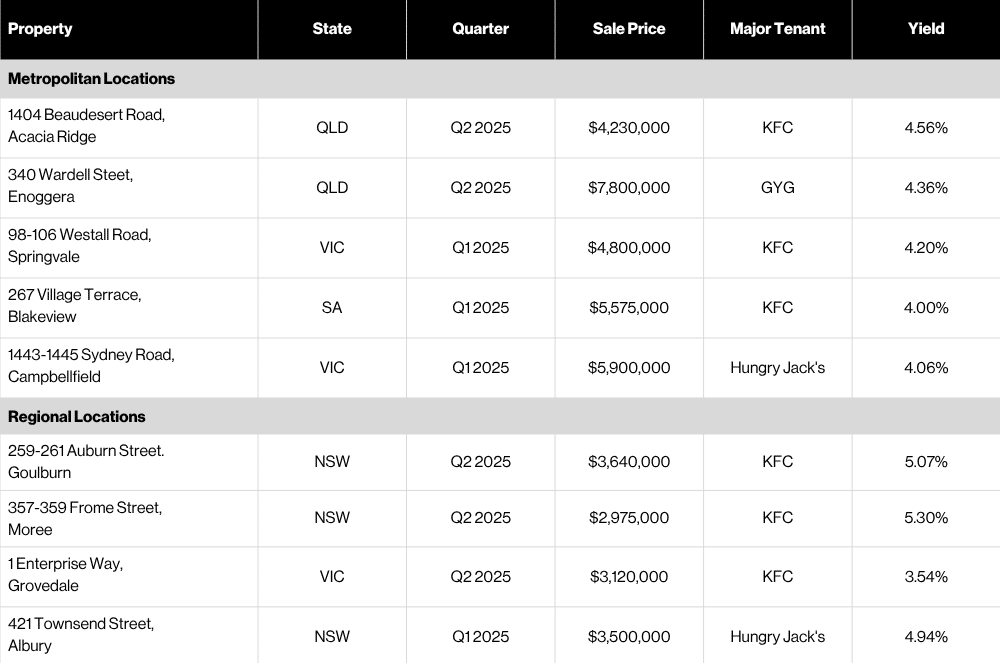

Fast Food Transaction Highlights

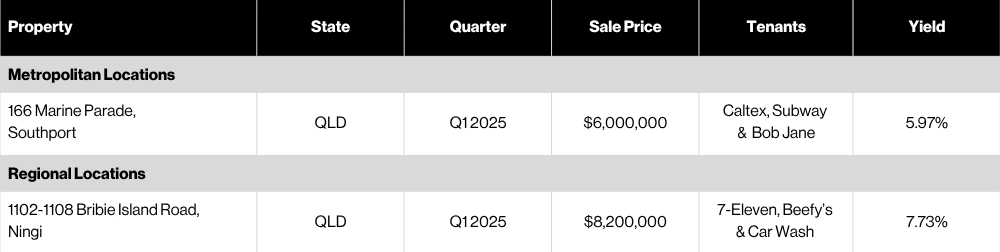

Service Station / Fast Food Transaction Highlights

At Costi Cohen, we actively source high-performing commercial assets with long-term tenancy strength. If you are looking to secure an investment that will hold its value and deliver stable income across all market cycles — get in touch with us today.